trust capital gains tax rate 2019

It also deals with situations where a person disposes of an. For tax year 2019 the 20 rate applies to amounts above 12950.

Biden Capital Gains Tax Rate Would Be Highest In Oecd

A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends.

. The difference is likely. For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in 2020 the trust could. It continues to be important.

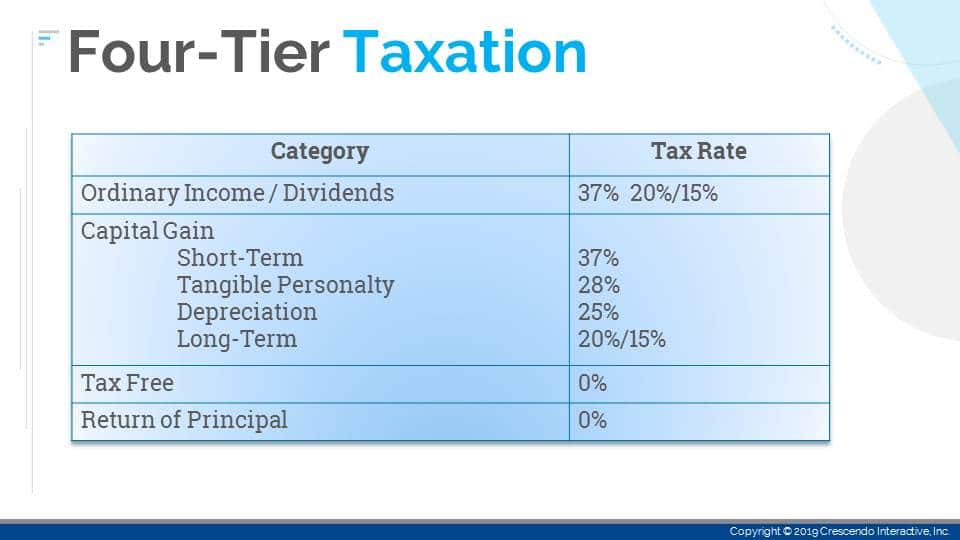

For tax year 2019 the 20 rate applies to. 255 plus 24 of the excess over 2550. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

HS294 Trusts and Capital Gains Tax 2019 This helpsheet explains how UK resident trusts are treated for Capital Gains Tax. Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals. A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends.

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. The first payment for a calendar year filer must be filed on or.

Guidance about the tax-free allowance and telling HMRC about capital gains made by a trust. Capital gains and qualified dividends. Some or all net capital gain may be taxed at 0 if your taxable income is less than.

2022 Long-Term Capital Gains Trust Tax Rates. Many people who create a revocable living trust place their homes in the trust. However long term capital gain generated by a trust still.

By doing this you do not give up your right to claim a capital gains tax exclusion when. 1839 plus 35 of the excess over 9150. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended.

Due on the 15th day of the 4th month after the tax year ends. The following Capital Gains Tax rates apply. Income over 12500 is taxed at a rate of 37 percent while capital gains and qualified dividends over 12700 are taxed at a rate of only 20 percent.

Estimated Payments for Taxes.

Certain Trusts May Help Lift The Weight Of A State Tax Burden Putnam Investments

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

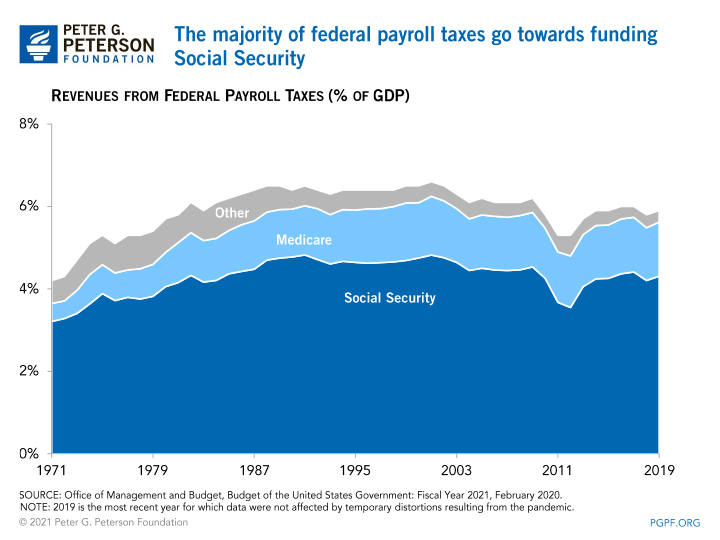

Payroll Taxes What Are They And What Do They Fund

2021 Trust Tax Rates And Exemptions

Trust Tax Rates And Exemptions For 2022 Smartasset

2020 Tax Reference Guide Facts You Need To Know About Taxes Tcv Trust Wealth Management

2019 Tax Bracket For Estate Trust Internal Revenue Code Simplified

Generation Skipping Trust Gst What It Is And How It Works

Publicly Traded Partnerships Tax Treatment Of Investors

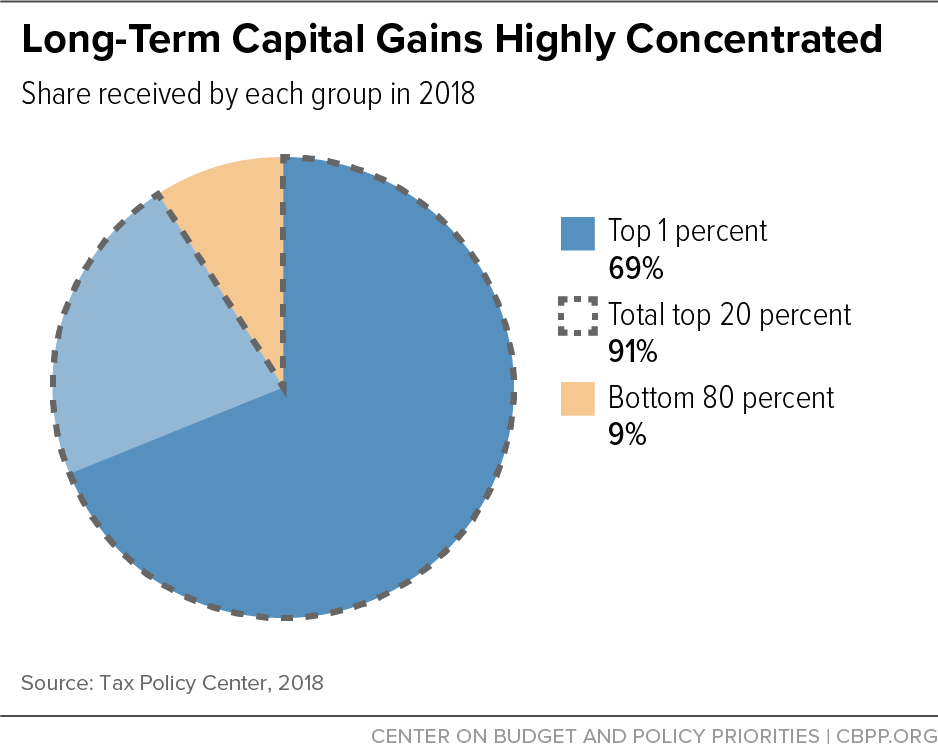

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Selling A Home Held In A Trust Is All About Timing

9 Facts About Pass Through Businesses

An Overview Of Capital Gains Taxes Tax Foundation

Planned Giving Hays Medical Center Foundation

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

2020 Tax Code Changes What You Need To Know Org Partners Advisor Group